What Is The Gross Income Limit For Tax Year 2025

What Is The Gross Income Limit For Tax Year 2025. What does standard deduction mean? The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Gross income means all income a person received in the form of money, goods, property and services that aren’t exempt from tax.

Use the paye tax calculator to work out how much income tax an employee needs to pay, in a pay period that is in the current tax year.

Tax rates for the 2025 year of assessment Just One Lap, What does standard deduction mean? Here are the income tax slabs under new.

What is a Roth IRA? The Fancy Accountant, Income tax slab income tax rate income tax slab income tax rate; With the passage of secure 2.0 act, effective 1/1/2025 you may also be eligible to contribute to.

IRA Contribution Limits in 2025 Meld Financial, Gross income means all income a person received in the form of money, goods, property and services that aren't exempt from tax. The ira limit for 2025 is $6,500 per taxpayer (or $7,500 for those older than 50).

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, Income tax brackets — for taxable income in 2025. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

2025 Roth Limit Rory Walliw, This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following. Income from 3 lakh and 6 lakh will be taxed at 5%, 6 lakh to 9 lakh will be taxed at 10%, 9 lakh to 12 lakh will be taxed at 15%,12 lakh to.

What Is Gross + Why It’s Important Rocket Mortgage, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. You probably have to file a tax return if your 2025 gross income was at least $13,850 as a single filer, $27,700 if married filing jointly or $20,800 if head of household.

Hsa Limits 2025 Rycca Clemence, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). The ira limit for 2025 is $6,500 per taxpayer (or $7,500 for those older than 50).

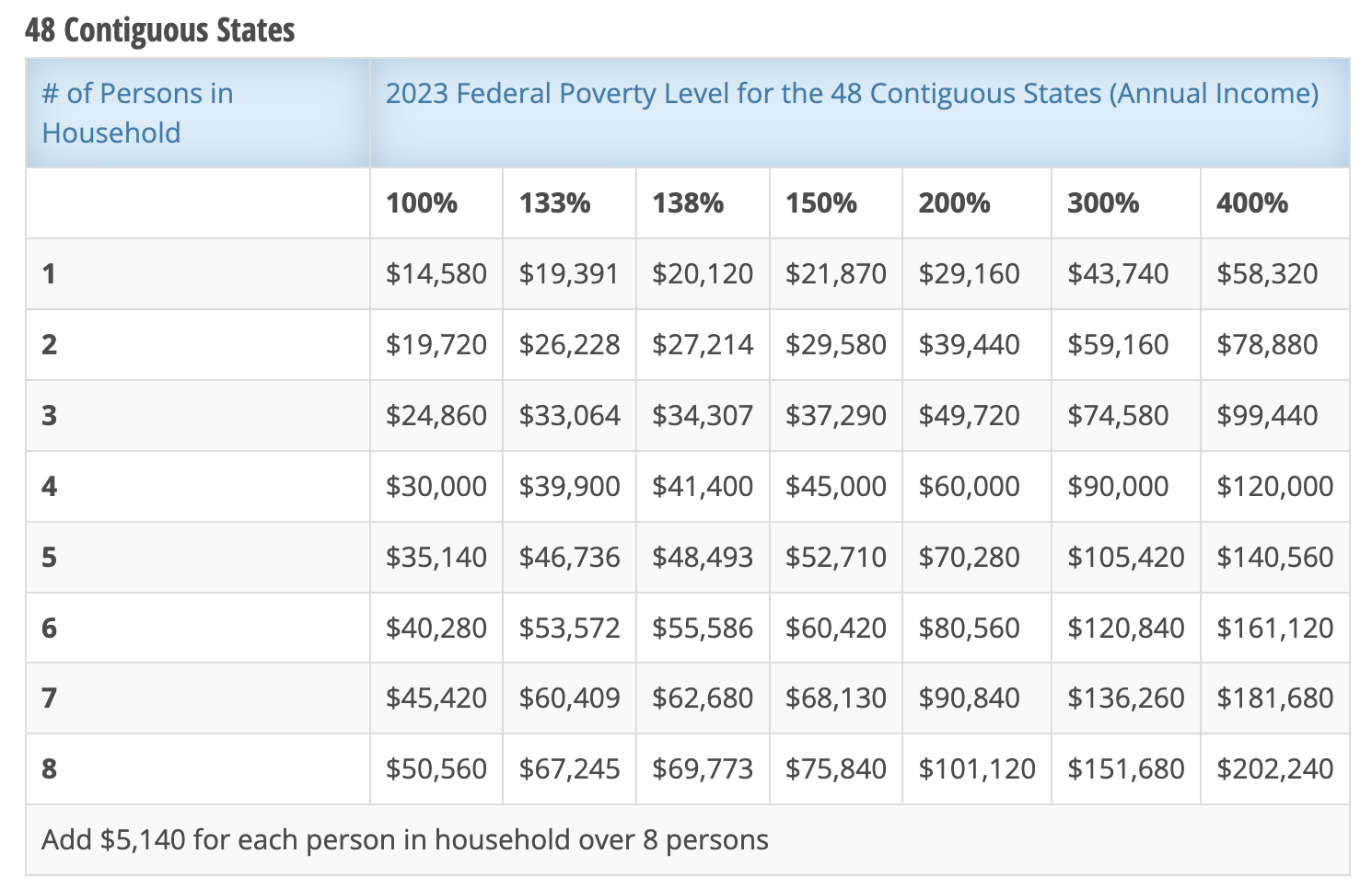

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, The standard deduction is a. Up to ₹ 2,50,000 nil:

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Senior citizen (who is 60 years or more at. Use the paye tax calculator to work out how much income tax an employee needs to pay, in a pay period that is in the current tax year.

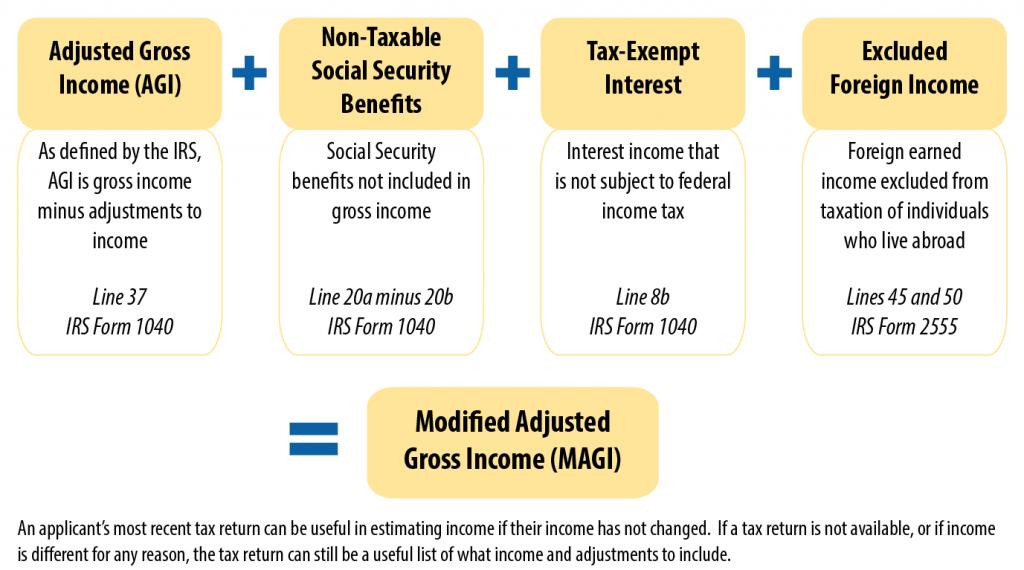

Modified Adjusted Gross (MAGI), Income tax brackets — for taxable income in 2025. Up to ₹ 2,50,000 nil:

The limit on charitable cash contributions is 60% of the taxpayer's adjusted gross income for tax years 2025 and 2025.

What Is The Gross Income Limit For Tax Year 2025. What does standard deduction mean? The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing…