Irs Ctc 2025

Irs Ctc 2025. Biden aims to revive monthly child tax credit payments in 2025 budget plan. Net sales at rs 1,154.77 crore in march 2025 up 19.66% from rs.

Families with children who are dependents, under the age of 17, and have a social security number that is valid for employment in the u.s.

Ctc For 2025 Irs Reyna Clemmie, For tax year 2025, the expanded. This press release discusses the fourth right of the taxpayer bill of rights right under section 7803(a)(3).

How To Calculate Additional Ctc 2025 Irs Abbye Elspeth, Discover the truth behind the rumors of the 2025 irs ctc monthly payments stimulus in our latest video. House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various tax breaks for businesses.

Irs Ctc 2025 Reyna Clemmie, 965.02 crore in march 2025. The amount a family can receive is up to $2,000 per child, but it's only partially refundable.

When Will Ctc Refunds Be Issued 2025 Ava Meagan, The child tax credit is a tax break families can receive if they have qualifying children. House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various tax breaks for businesses.

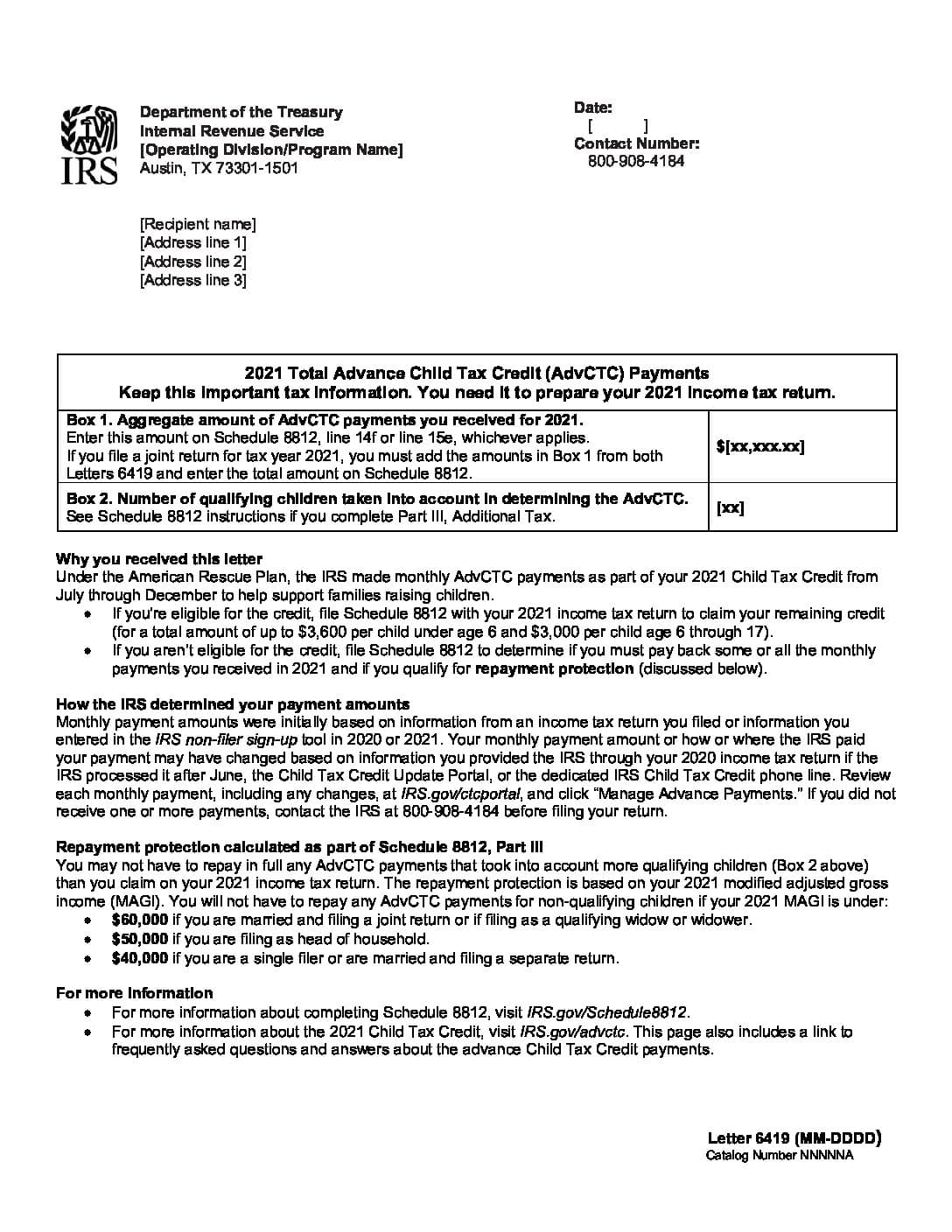

IRCTC Agent Requirements 2025 2025 EduVark, Each payment will be up to $300 per month for each child under age 6 and up to. Washington — the treasury department and the internal revenue service today urged families to take advantage of a special online tool that can help them determine whether they qualify for the child tax credit and the special monthly advance payments beginning on july 15.

Irs Ctc Refund Dates 2025 Cyb Laural, A family will expect to receive these payments immediately if they meet the eligibility standard and fire their prior years taxes. At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax credit, a policy that has gained popularity and bipartisan support.

IRCTC Share Price Target 2025 2025 2025 2030 Market High Low, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. How many kids would benefit from the ctc changes?

Irctc Agent New Update 2025 YouTube, The irs is issuing $8,700 stimulus checks to qualifying americans in 2025. The child tax credit update portal allows families to verify their eligibility for the payments and if they choose to, unenroll, or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year.

IRCTC Recruitment 2025 Check Post, Qualification, Age Limit and Other, You must file a 2025 tax return by april 15, 2025 (october 15, 2025 with extension). Eligible families will receive advance payments, either by direct deposit or check.

IRCTC Share Price Target 2025, 2025, 2025, 2025, 2026, 2027, 965.02 crore in march 2025. Those genuine payments came directly from the irs.

Washington — the treasury department and the internal revenue service today urged families to take advantage of a special online tool that can help them determine whether they qualify for the child tax credit and the special monthly advance payments beginning on july 15.