Delaware Estate Tax 2025

Delaware Estate Tax 2025. Estimated tax payments should be made: As a result of fraud prevention measures that protect.

By al dinicola | posted on february 19, 2025. In this video, we’re going to talk about what estate taxes are and we’ll dig into the basics of delaware estate taxes.we’ll also show you different tax plann.

The exemption for the federal estate tax is $13.61 million for deaths in 2025, up from $12.92 million in 2025.

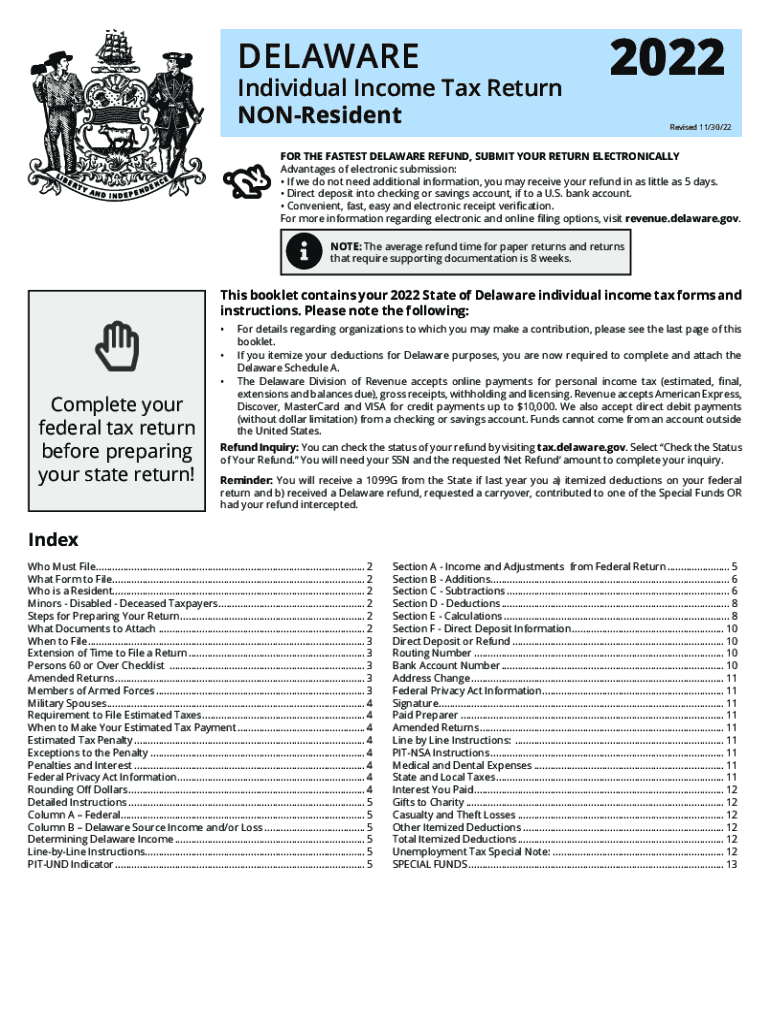

Delaware Taxes 20222024 Form Fill Out and Sign Printable PDF Template airSlate SignNow, Currently, the estate tax in delaware in 2025 is 0%. In this video, we're going to talk about what estate taxes are and we'll dig into the basics of delaware estate taxes.we’ll also show you different tax plann.

Estate and Inheritance Taxes Urban Institute, Because the delaware estate tax was repealed for individuals dying on or after january 1, 2018, this return is not required for 2019. Delaware’s division of revenue will begin processing 2025 individual income tax returns on january 23, 2025.

Property Tax Rates By State 2025 Fannie Stephanie, Estate taxes are levied against the value of an estate or trust. Counties in delaware collect an average of 0.43% of a property's.

Tax rates for the 2025 year of assessment Just One Lap, By al dinicola | posted on february 19, 2025. Over the past five years the popularity of delaware statutory trusts (dsts) has increased in investor awareness.

About Delaware Form 5403 Real Estate Tax Return, Counties in delaware collect an average of 0.43% of a property's. What is the inheritance tax in delaware?

2025 Tax Chart Irs Wilow Kaitlynn, The exemption for the federal estate tax is $13.61 million for deaths in 2025, up from $12.92 million in 2025. If you have an estate involving a decedent who.

Real Estate Property Tax By State, The 2025 tax rates and thresholds for both the delaware state tax tables and federal tax tables are comprehensively integrated into the delaware tax calculator for 2025. Taxes to sell an inherited property:

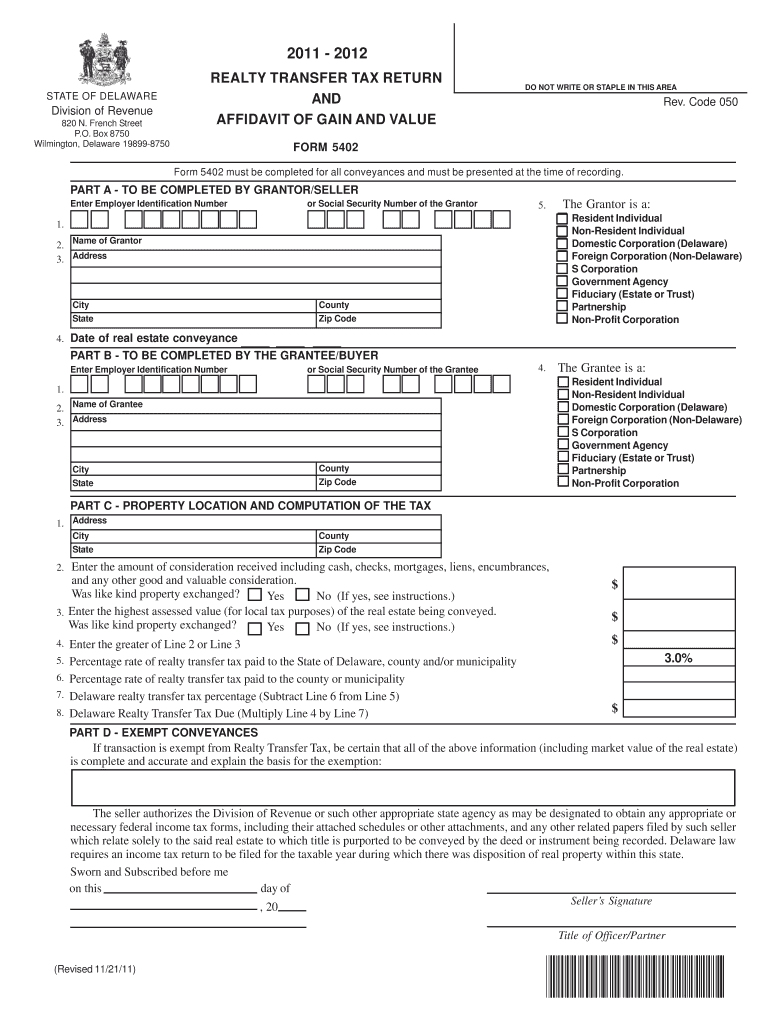

Form 5402 Fill out & sign online DocHub, The exemption for the federal estate tax is $13.61 million for deaths in 2025, up from $12.92 million in 2025. Currently, the estate tax in delaware in 2025 is 0%.

Annual Tax Table 2025 Lily Shelbi, Dsts are considered securities under federal law. If you have an estate involving a decedent who.

Historical Estate Tax Exemption Amounts And Tax Rates, There are no inheritance or estate taxes in delaware, making it one of the 38 states nationwide that. Discover the delaware capital gains tax and its rates in 2025.