6055 And 6056 Reporting Deadlines 2025

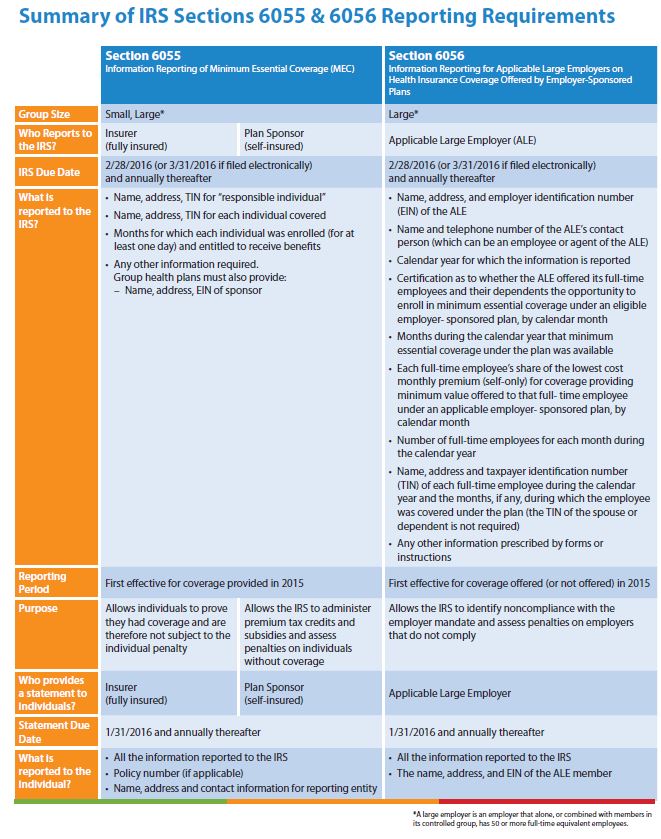

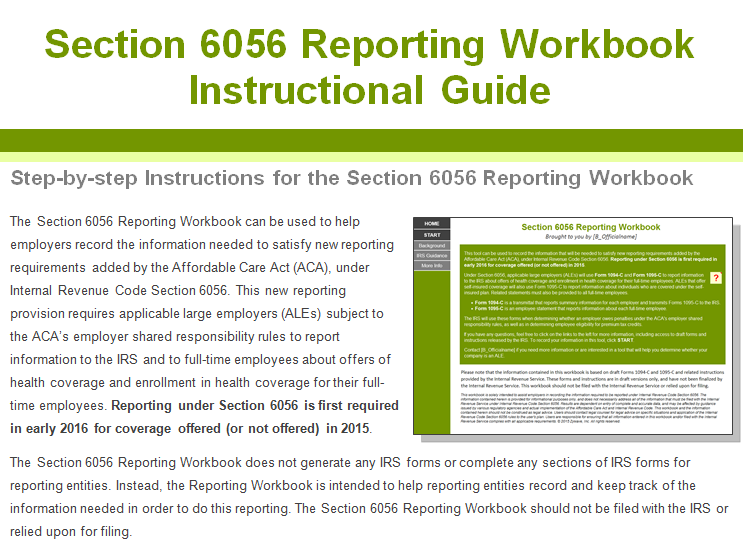

6055 And 6056 Reporting Deadlines 2025. Employers who are subject to affordable care. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early.

However, since this is a sunday, electronic returns must be filed by the next business day, which is april 1, 2025. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early.

Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.

IRS 6055 and 6056 Reporting Shenandoah Valley Group, Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.

EBIA on Code §§ 6055 and 6056 Reporting In 2 Minutes YouTube, Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting. By hhs insurance february 7, 2025 no comments.

Employer Reporting of Health Coverage—Sections 6055 & 6056 Central PA, Employers who are subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 have upcoming reporting deadlines in 2025. Aca reporting requirements for 2025 this guide is all about:

Affordable Care Act (ACA) Reporting Requirements Forms 6055 and 6056, However, since this is a sunday, electronic returns must be filed by the next business day, which is april 1, 2025. Employers who are subject to affordable care.

IRS Reporting Requirement 6055 And 6056, However, since this is a sunday, electronic returns must be filed by the next business day, which is april 1, 2025. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.

IRC 6055 & 6056 ACA Employer Reporting Requirements YouTube, Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early. Employers subject to affordable care act (aca) reporting.

IRS Releases Draft 2015 Forms for 6055/6056 Reporting, Employers who are subject to affordable care. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should.

IRS Reporting Requirements Section 6055 and 6056 Patient Protection, Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to. Aca reporting under section 6055/6056;.

ACA Seminar SelfInsured Employer 6055 and Applicable Large Employer, However, since this is a sunday, electronic returns must be filed by the next business day, which is april 1, 2025. Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early.

Affordable Care Act (ACA) Reporting Requirements Forms 6055 and 6056, Employers who are subject to affordable care. Aca reporting under section 6055/6056;.

Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.

Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting deadlines in early.